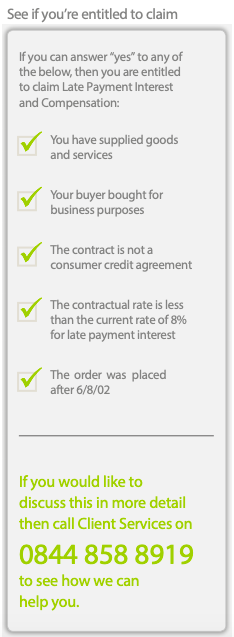

You may have tried all methods of encouraging payment yet you’re still not being paid for goods or services that you’ve provided. If that’s the position you’re in, you are entitled to claim Late Payment Interest. This can be highly cost-effective as it can contribute to collection costs or even off set them. You can claim interest at 8% over Bank of England Base Rate and compensation of £40 – £100 for each unpaid invoice. Interest rates are set for 6 months, so they don’t keep changing as Base Rate changes.

The compensation entitlement varies in accordance with the size of the debt:

5 Reasons To Allow Us To Claim Late Payment Interest:

- Improve your cashflow

- Deter persistent late payers and high credit risk customers

- Use it as a negotiation tool to recover the amount by waiving compensation

- Allows you to focus on core responsibility of the development and growth of your business

- You’re entitled to it!

Plus, if you’re concerned about damaging the goodwill of the relationship with your customer, then by allowing us to claim on your behalf, you are personally removed from the negotiations. By integrating the legislation into your payment terms, your customers will become educated to the fact that this is the way you like to do business. However, don’t forget if they are persistent late payers, they may not be the best customer for you!

Contact Us

If you are a business and would like to know more about how we can help you please complete the short form below and we will get back to you as soon as possible.